Sinfin Lane: Difference between revisions

add page specific text |

|||

| Line 4: | Line 4: | ||

==Summary== | ==Summary== | ||

An integrated [[EfW]] facility with other treatment technology, with the [[EfW]] based upon [[Gasification]] technology and not considered an [[ERF]] based on not having [[R1]] status. Sinfin Lane has permitted operational capacity of 190,000 tonnes per annum, although the [[EfW]] element of the facility is thought to be slightly less than this. It was developed and is operated by [[Resource Recovery Solutions]], a subsidiary of [[ | An integrated [[EfW]] facility with other treatment technology, with the [[EfW]] based upon [[Gasification]] technology and not considered an [[ERF]] based on not having [[R1]] status. Sinfin Lane has permitted operational capacity of 190,000 tonnes per annum, although the [[EfW]] element of the facility is thought to be slightly less than this. It was developed and is operated by [[Resource Recovery Solutions]], a subsidiary of [[Renewi]], although it is reported that the contract has been terminated and a new operating partner is being sought<ref>[https://www.letsrecycle.com/news/latest-news/derbyshire-councils-prepare-for-end-of-sinfin-contract/ Letsrecycle Article]</ref>. | ||

==History== | ==History== | ||

Revision as of 15:11, 11 February 2020

| Sinfin Lane Mothballed | |

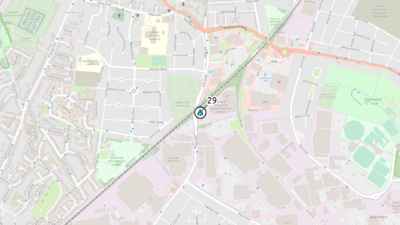

See Residual EfW → page for a larger UK Wide map. | |

| Waste Licence | KP3236HW |

| Operator | Resource Recovery Solutions (Derbyshire) Ltd |

| Region | East Midlands |

| Operational Capacity | 0ktpa |

| Is site R1? | fal |

| When was R1 Granted? | |

| What was the R1 value | 0.00 |

| Electrical Capacity | 7.50MWe |

| Number of Lines | 0 |

| Number of Turbines | 0 |

| CHP | No |

| Technology Approach | ACT |

| Funding Type | PPP |

Operators Annual Report

Input Data

| Year | HH | C&I | Clin | RDF | Total |

|---|---|---|---|---|---|

| 2016 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2017 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2018 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2019 | 39211.00 | 0.00 | 0.00 | 0.00 | 39211.00 |

| 2020 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2021 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2022 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Output Data

| Year | IBA | IBA %ge of Tot IN | APC | APC %ge of Tot IN |

|---|---|---|---|---|

| 2016 | 0.00 | 0.00% | 0.00 | 0.00% |

| 2017 | 0.00 | 0.00% | 0.00 | 0.00% |

| 2018 | 0.00 | 0.00% | 0.00 | 0.00% |

| 2019 | 6160.00 | 15.71% | 1327.00 | 3.38% |

| 2020 | 0.00 | 0.00% | 0.00 | 0.00% |

| 2021 | 0.00 | 0.00% | 0.00 | 0.00% |

| 2022 | 0.00 | 0.00% | 0.00 | 0.00% |

Summary

An integrated EfW facility with other treatment technology, with the EfW based upon Gasification technology and not considered an ERF based on not having R1 status. Sinfin Lane has permitted operational capacity of 190,000 tonnes per annum, although the EfW element of the facility is thought to be slightly less than this. It was developed and is operated by Resource Recovery Solutions, a subsidiary of Renewi, although it is reported that the contract has been terminated and a new operating partner is being sought[1].

History

The Sinfin Lane facility was built as an integrated solution primarily to service a 27 year PPP contract with Derbyshire County Council and Derby City Council signed in July 2010 to process around 190,000 tonnes per annum and was due to run to 2042. The facility diverts the 190,000 tonnes per annum from Landfill via a combination of Mechanical Biological Treatment, with the RDF output sent to the adjacent ATT/Gasification facility. The capacity of the ATT/Gasification is assumed to be slightly less than 190,000 tonnes per annum, operating over 3 lines[2] (the reported power output of 7.5MWe is more consistent with a single line 93,000 tonnes per annum plant as per Milton Keynes).

Plant

Originally built by Interserve under an EPC contract which started in 2014 (with a 2017 completion date) with the Gasification technology delivered by Energos, the contract was delayed through commissioning and the MBT plant suffered complaints of odour. Originally estimated to cost £145m as a joint venture between Interserve and Renewi and funded by the Green Investment Bank[3]. Due to the accumulated losses by Interserve on this project and the Glasgow project led to Interserve exciting the EfW market in early 2017[4]